work opportunity tax credit questionnaire ssn

However some companies go on mass hiring sprees targeting certain populations under these survey to take advantage of the tax credits. The WOTC forms are federal forms to help determine if you will make your employer eligible for a tax credit when they hire you.

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit WOTC Frequently Asked Questions.

. Felons at risk youth seniors etc. Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure Yes No Not Sure WORK OPPORTUNITY TAX CREDIT WOTC QUESTIONNAIRE First Name Last Name Address City State Zip Date of Birth Social Security Number a. This notice provides transition relief by extending the 28-day deadline for employers to submit a certification request for an individual who begins work on or after.

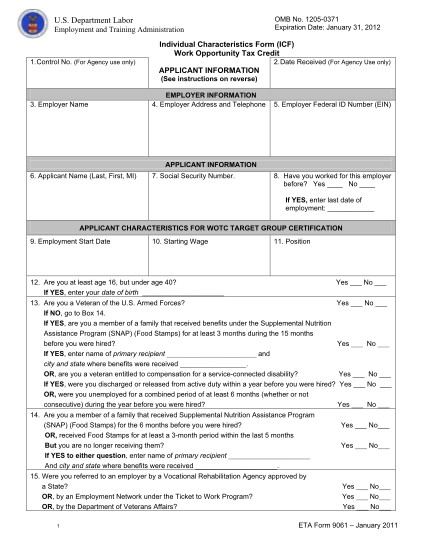

The Disabled Veterans Rate DAV - A WOTC credit equal to 40 of the first 12000 in qualified first-year wages for a maximum credit of. Employer Federal ID Number EIN APPLICANT INFORMATION. Completion of this form is voluntary and may assist members of targeted groups in.

The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are. The Full Rate - A WOTC credit equal to 40 of the first 6000 in qualified first year wages for a maximum credit of 2400. We would like you to know that although this questionnaire is voluntary we encourage you to complete it as it is used to assist members of targeted groups in securing employment.

Questions and answers about the Work Opportunity Tax Credit program. Complete only this side. The Department of the Treasury and the Internal Revenue Service IRS issued IRS Notice 2021-43 Work Opportunity Tax Credit WOTC Transition Relief under Internal Revenue Code 51 effective August 10 2021.

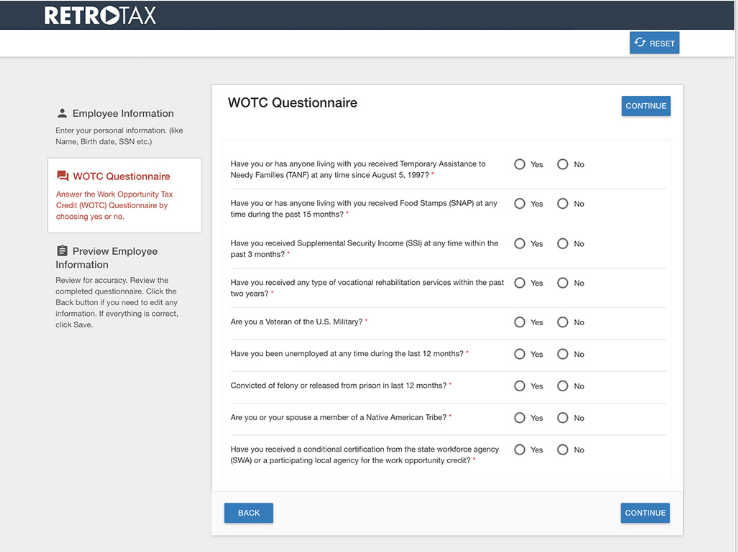

Work Opportunity Tax Credit Questionnaire. Last Name First Name Middle Initial. These surveys are for HR purposes and also to determine if the company is eligible for a tax creditdeduction.

Employer Address and Telephone 5. There are two sets of frequently asked questions for WOTC customers. Below you will find the steps to complete the WOTC both ways.

APPLICANT INFORMATION See instructions on reverse 2Date Received For Agency Use only EMPLOYER INFORMATION 3. Please take this opportunity to complete an additional applicant assessment. The WOTC promotes the hiring of individuals who qualify as members of target groups by providing a federal tax credit incentive of up to 9600 for employers who hire them.

So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit. It asks the applicant about any military service participation in government assistance programs recent unemployment and other targeted questions. Work Opportunity Tax Credit questionnaire.

I also thought that asking for a persons age was discriminatory. It asks for your SSN and if you are under 40. I dont just give anyone my SSN unless I am hired for a job or for credit.

Page one of Form 8850 is the WOTC questionnaire. The WOTC-certified employee must work a minimum of 400 hours or 180 days of service for the employer. The information will be used by the employer to complete the employers federal tax return.

If so you will need to complete the questionnaire when you apply to a position or after youve been hired depending on the employers workflow. Your name Social security number a Street address where you live City or town state and ZIP code County Telephone number. The Work Opportunity Credit a See separate instructions.

Some companies get tax credits for hiring people that others wouldnt. Fill in the lines below and check any boxes that apply. Make sure this is a legitimate company before just giving out your SSN though.

Work Opportunity Tax Credit Questionnaire Employers receive substantial tax credits for hiring certain applicants under the Work Opportunity Tax Credit or WOTC a program created by the US. The Protecting Americans from Tax Hikes Act of 2015 Pub. SSI does NOT include Social Security Disability Retirement or Death Benefits.

Its called WOTC work opportunity tax credits. Work Opportunity Tax Credit 1. Why is my SS and date of birth required on wotc form.

114-113 the PATH Act reauthorizes the WOTC program and Empowerment Zones without changes through December. The answers are not supposed to give preference to applicants. Completing Your WOTC Questionnaire.

Some employers integrate the Work Opportunity Tax Credit questionnaire in talentReef. Questions and answers about the Work Opportunity Tax Credit Online eWOTC service. Internal Revenue Code Section 51 d 13 permits a prospective employer to request the applicant to complete WOTC Form 8850 and give it to the prospective employer.

Ad TALX Tax Credit Questionnaire More Fillable Forms Register and Subscribe Now.

Tax Credit Solution By Thomas And Thorngren Inc By Thomas Company Icims Marketplace

Uncover Hidden Hiring Incentives With Retrotax And Jazzhr Jazzhr

Adp Work Opportunity Tax Credit Wotc Avionte Bold

14 Monthly Household Budget Template Free To Edit Download Print Cocodoc

Work Opportunity Tax Credit What Is Wotc Adp

Work Opportunity Tax Credit Questionnaire

Adp Work Opportunity Tax Credit Wotc Avionte Bold

Wotc Survey Form Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit What Is Wotc Adp

Retrotax Tax Credit Administration Jazzhr Marketplace

Wotc Survey Form Fill Online Printable Fillable Blank Pdffiller

Wotc Survey Form Fill Online Printable Fillable Blank Pdffiller